FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Descrição

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

Maximum Taxable Income Amount For Social Security Tax (FICA)

2023 FICA Tax Rate, Social Security & Medicare tax rate, Limit

Social Security wage base is $160,200 in 2023, meaning more FICA

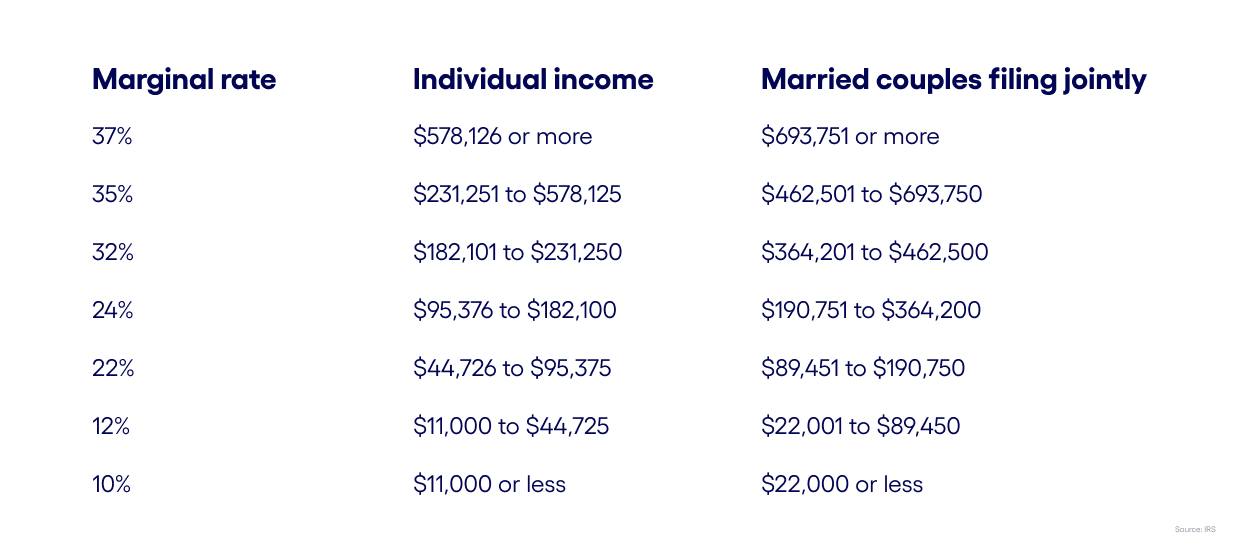

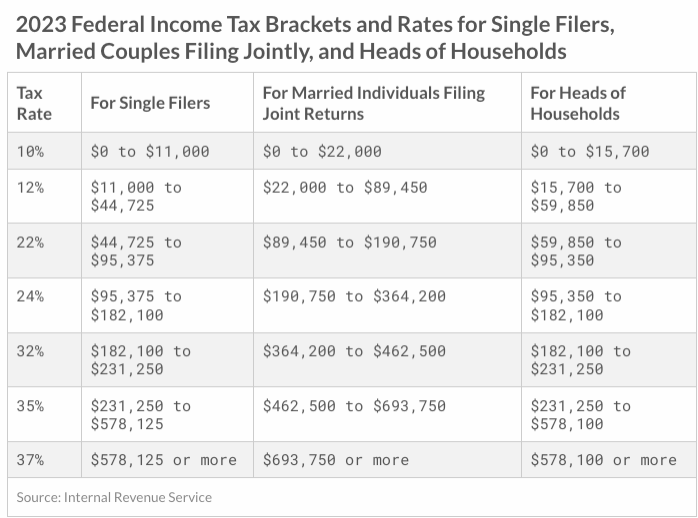

How the 2023 Income Tax Brackets Can Affect Your Business

2023 Tax Brackets, Social Security Benefits Increase, and Other

Tax Reduction Plans for Small Businesses In 2022 - Fully Accountable

2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes

FICA Tax in 2022-2023: What Small Businesses Need to Know

2023 ultimate tax guide: tax documents checklist

de

por adulto (o preço varia de acordo com o tamanho do grupo)