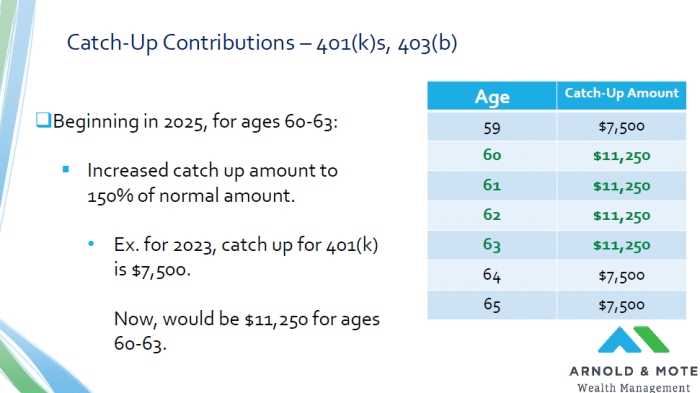

SECURE 2.0: Big changes to 401(k) catch-up contributions in 2024

Por um escritor misterioso

Descrição

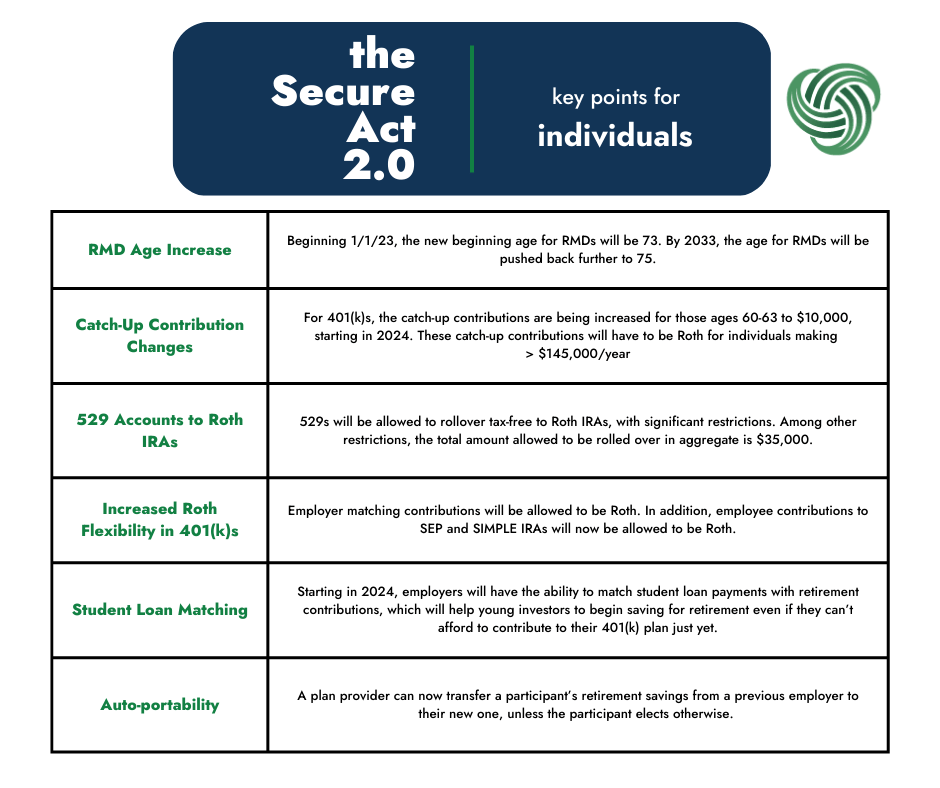

Mandatory Roth Catch-up Contributions for High Wage Earners

2 Things Every Investor Should Know About SECURE Act 2.0

What Happens to Catch-Up Contributions in Secure Act 2.0 When Your

IRS Increases 401(k) Limit to $23,000 for 2024, IRA Limit to

SECURE Act 2.0: What 401(k) Managers Need to Know for 2024

IRS 401(k) Contribution Roth Rule Change Delay: High Earners Get

Secure Act 2.0 - New RMD Ages, 529 to Roth Transfers, Roth

The 401(k) plan, reimagined: Key SECURE 2.0 changes that take

401(k) Industry Still Pleading for Delay in SECURE 2.0 Catch-Up

Changes Coming in 2024 for High Earners' 401(k) Catch-Up

de

por adulto (o preço varia de acordo com o tamanho do grupo)