Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Descrição

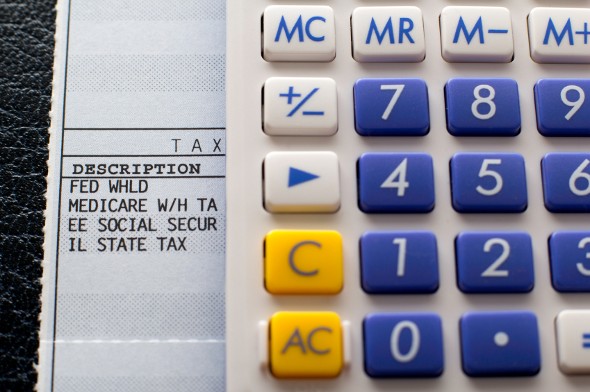

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

How the Wage Base Limit Affects Your Social Security

What Is the FICA Tax?, Retirement

Breaking Down the Taxable Wage Base Limit: Implications for Your

How the Wage Base Limit Affects Your Social Security

What Is FICA, and How Much Is FICA Tax?

The Evolution of Social Security's Taxable Maximum

Understanding Payroll Taxes and Who Pays Them - SmartAsset

Publication 505 (2023), Tax Withholding and Estimated Tax

Understanding Your Paycheck

Minimum Wage and Overtime Pay, FICA

:max_bytes(150000):strip_icc()/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is the Self-Employed Contributions Act (SECA) Tax?

What Is FICA Tax Understanding Payroll Tax Requirements

Employee Retention Credit - Anfinson Thompson & Co.

What are the major federal payroll taxes, and how much money do

Social Security wage base is $160,200 in 2023, meaning more FICA

de

por adulto (o preço varia de acordo com o tamanho do grupo)

.jpg)