FICA Tax: Understanding Social Security and Medicare Taxes

Por um escritor misterioso

Descrição

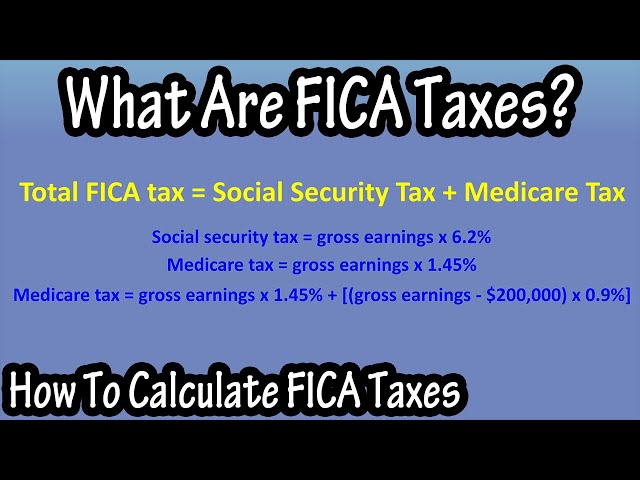

Both employees and employers are required to pay FICA tax, which is withheld from an employee

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

FICA Tax: 4 Steps to Calculating FICA Tax in 2023

The Average American Pays This Much in Social Security Payroll Tax

Keyword:current fica tax rate - FasterCapital

Payroll Tax Rates (2023 Guide) – Forbes Advisor

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

What is FICA

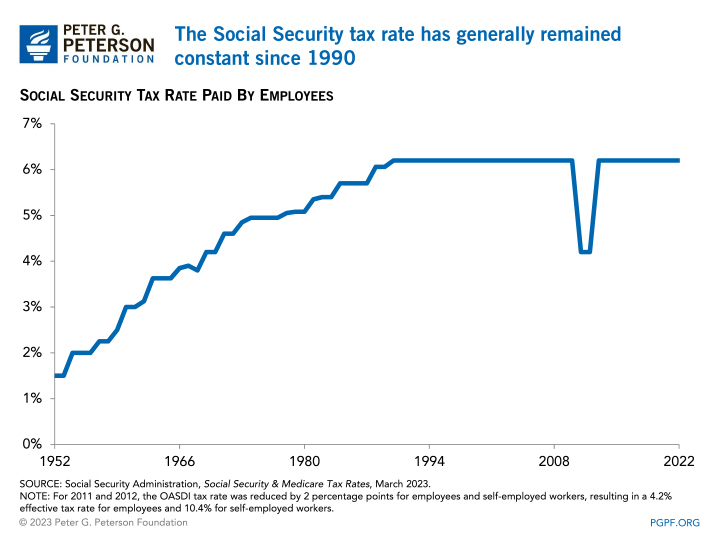

SOCIAL SECURITY TAX AND THE MAXIMUM TAXABLE INCOME LIMIT

What are the major federal payroll taxes, and how much money do they raise?

Payroll Taxes: What Are They and What Do They Fund?

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)