What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Descrição

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

Social Security COLA Increase for 2023: What You Need to Know - The New York Times

Program Explainer: Windfall Elimination Provision

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

What is Social Security Tax?

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset

Payroll tax - Wikipedia

Social Security Tax Definition, How It Works, and Tax Limits

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Who Is Exempt From Social Security Taxes? - SmartAsset

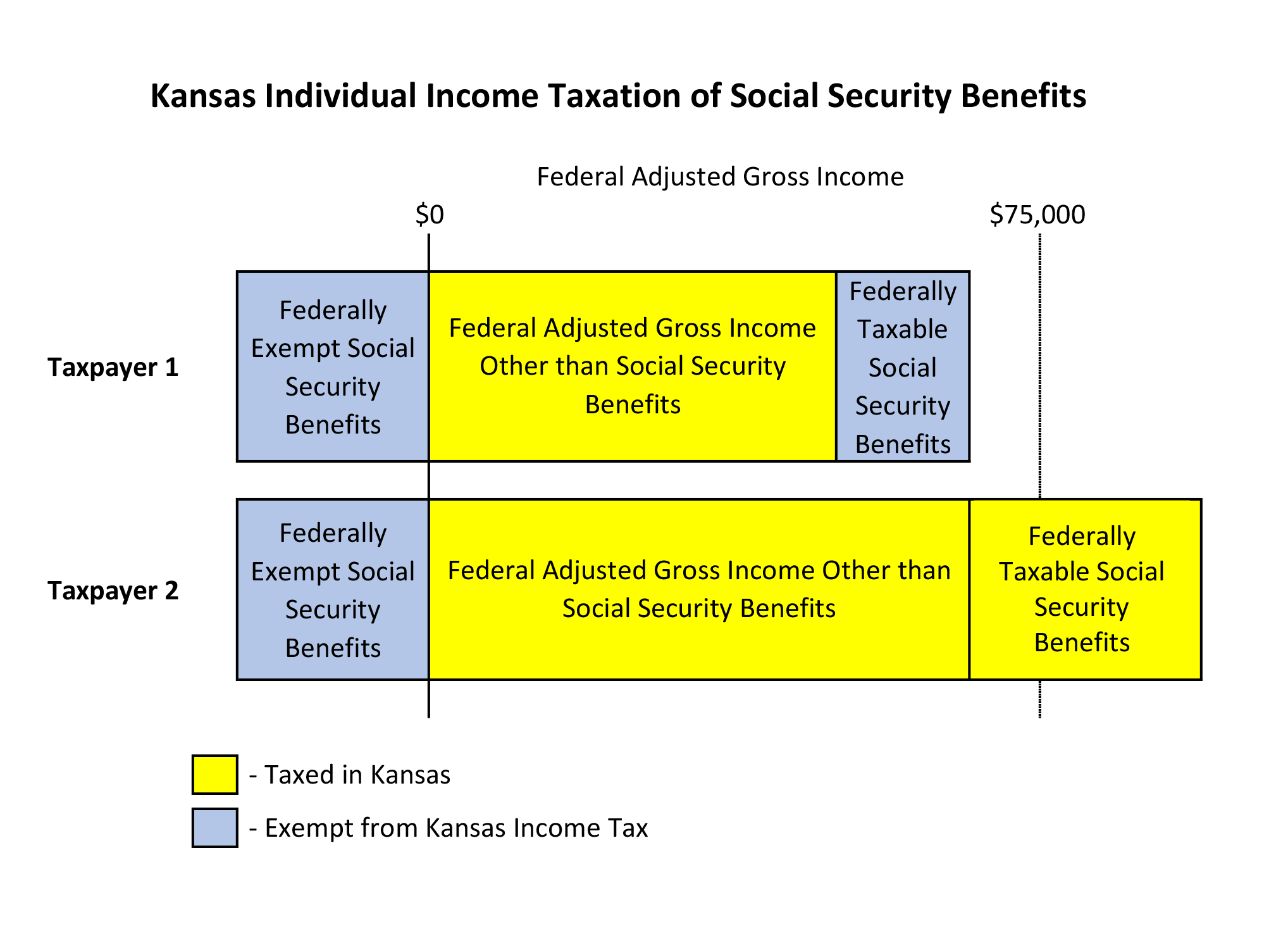

Income Taxation of Social Security Benefits – KLRD

Income Definitions for Marketplace and Medicaid Coverage - Beyond the Basics

37 states don't tax your Social Security benefits — make that 38 in 2022 - MarketWatch

de

por adulto (o preço varia de acordo com o tamanho do grupo)