Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Descrição

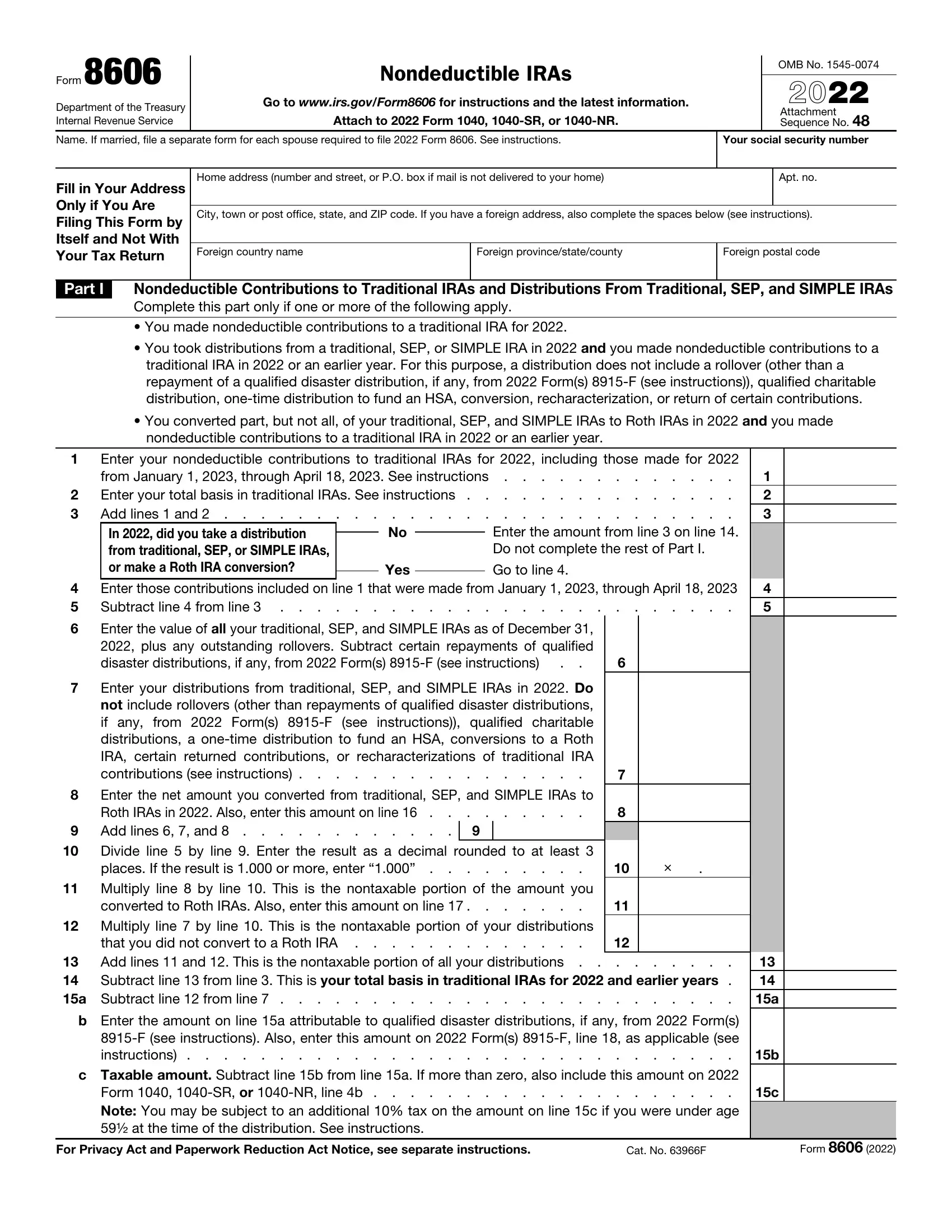

Publication 970 - Introductory Material Future Developments What's New Reminders

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

American Opportunity Tax Credit

Do You Have to Report VA Disability as Income for 2023 Taxes? - Hill & Ponton, P.A.

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

About IRS Publication 970: Tax Benefits for Education

Teachers' out-of-pocket classroom costs worth $300 tax break - Don't Mess With Taxes

Tuition and Fees Deduction for Higher Education - TurboTax Tax Tips & Videos

Publication 970 (2022), Tax Benefits For Education Internal, 60% OFF

IRS CP 79- We Denied One or More Credits Claimed on Your Tax Return

Teacher Expense Income Tax Deduction Raised to $300 - CPA Practice Advisor

Tax Resources

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Publication 970 (2022), Tax Benefits for Education

de

por adulto (o preço varia de acordo com o tamanho do grupo)