2021 FICA Tax Rates

Por um escritor misterioso

Descrição

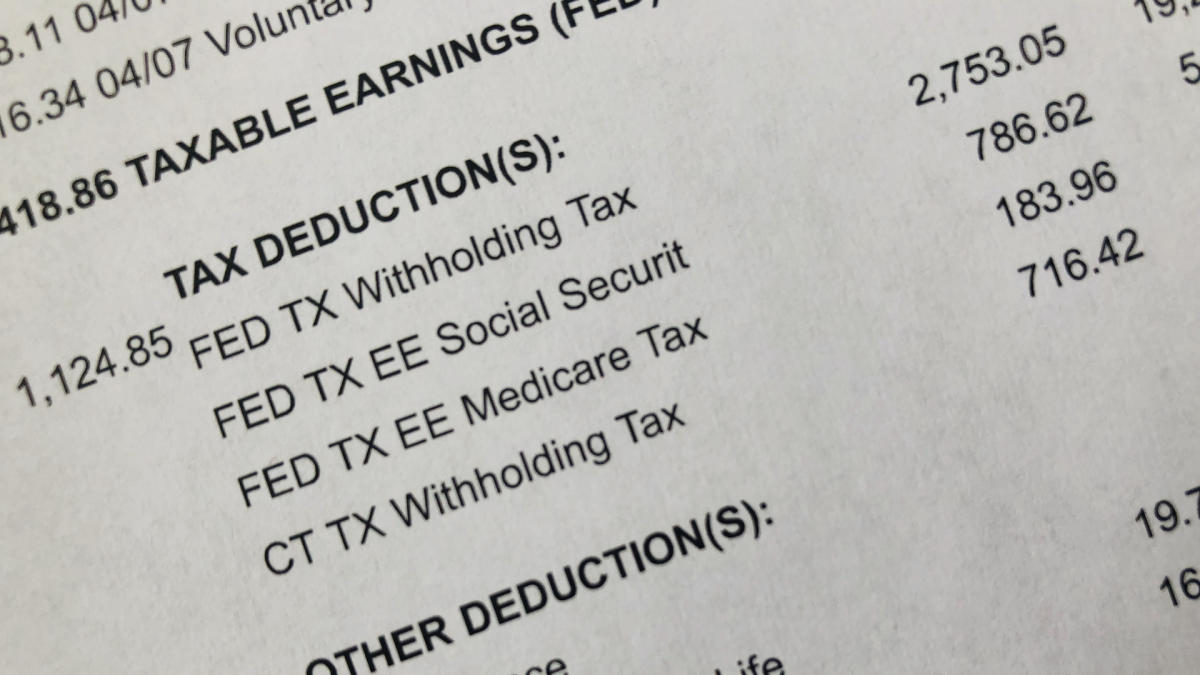

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

Distributional Effects of Raising the Social Security Payroll Tax

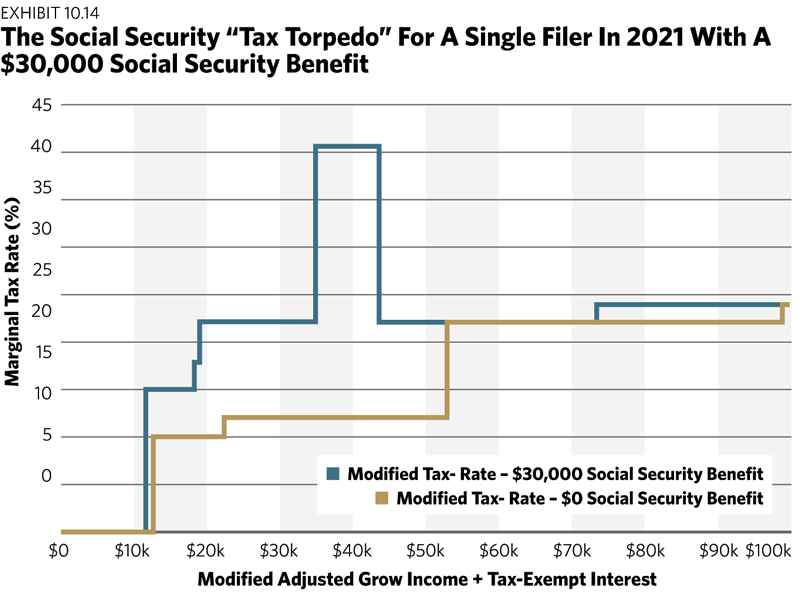

Avoiding The Social Security Tax Torpedo

What is FICA Tax? - The TurboTax Blog

The 2021 “Social Security wage base” is increasing - WellsColeman

FICA tax rate 2022: How can you adjust you Social Security and Medicare taxes?

What is the FICA Tax and How Does it Connect to Social Security?

Understanding FICA and How It Affects Your Primary Insurance Amount - FasterCapital

2021 Wage Base Rises for Social Security Payroll Taxes

What is the maximum Social Security tax in 2021? Is there a Social Security tax cap? - AS USA

FICA Tax: What It is and How to Calculate It

Withholding FICA Tax on Nonresident employees and Foreign Workers

2021 Wage Cap Rises for Social Security Payroll Taxes

The Evolution of Social Security's Taxable Maximum

de

por adulto (o preço varia de acordo com o tamanho do grupo)